-

Key observation #4

There is strong demand for GovERP’s business process maps, designs, patterns and related documentation to be made available for reuse by other government entities (a Tier 3 reuse opportunity). While the Digital Transformation Agency’s Australian Government Architecture (AGA) provides a centralised site to make reusable designs available, there may be merit in a secure sharing facility to disseminate sensitive materials that are not suitable for publication on the AGA website.

Recommendation

The Digital Transformation Agency to provide a centralised site to make confirmed reusable designs available, including secure sharing facility to disseminate sensitive materials that are not suitable for publication on the AGA website.

Report reference

Off -

Key observation #5

GovERP was envisaged as a single, whole-of-government technology hub. Componentisation of each capability for potential reuse is possible but has limited commercial effectiveness. Grouping of like entities may help to achieve economies of scale without the complexity of pursuing a whole-of-government, one-size-fits-all approach. Further, focussing on smaller-scale projects over shorter time limits may help minimise ERP uplift delivery risks.

The new ERP Category under the Software Marketplace Panel, coupled with the Department of Finance’s work to support a small-entity solution, may help to identify next steps for a collective or group-based approach.

Recommendation

Where possible, future ERP uplifts should group entities of similar complexity and scale (not necessarily aligned to portfolio, organisation, or other corporate service provision arrangements), to help achieve economies of scale and re-use without the challenge of pursuing a whole-of-government approach.

Report reference

Off -

-

-

GovERP reuse assessment background

-

2. Background

2.1 Assessment terms of reference

To support Commonwealth entities to implement future cost effective ERP uplifts, the independent reuse assessment has focused on:

- leveraging work already completed

- drawing out lessons learned, and

- uncovering opportunities for reuse of Service Australia’s ERP to support the new APS ERP approach.

The Assessment’s terms of reference, as detailed at Appendix A, sought to:

- Evaluate and understand what has been delivered to date.

- Evaluate and understand what has been spent to date against what has been delivered.

- Evaluate and understand the suitability of delivered outputs for reuse across the Commonwealth.

- Contribute standard designs, patterns, and other related guidance to the Australian Government Architecture.

- Articulate recommendations and guidance for reuse including information that will support entities to plan future ERP uplifts.

- Advise on potential costs, risks, and associated benefits, to carry out any remaining work envisaged by Services Australia to complete GovERP.

- Advise on potential ongoing costs to entities from reusing GovERP, if reuse can be supported.

- Identify alternative designs and pathways that might provide more cost-effective options for any remaining work.

- Identify any existing ‘readymade’ deployment configurations deemed suitable to allow direct onboarding of entities.

2.2 Assessment approach

-

The panel

The Assessment was led by a 4-person independent Panel of Eminent People (the Panel). The Panel brings together a unique set of independent, informed, and different perspectives from across government and the private sector. The Panel has extensive experience in leading complex transformation programs, including ERP systems.

The Panel consists of:

- Ms Maile Carnegie. Ms Carnegie is Group Executive Australia Retail, ANZ’s largest business, which serves five million retail customers through its network of branches, ATMs, and online and mobile banking applications and digital solutions. Since joining ANZ, Ms Carnegie has developed enterprise-wide digital capabilities within the organisation, including rolling out ERP systems.

- Ms Catherine D’Elia. Ms D’Elia is a Deputy Secretary, Corporate Services, in the NSW’s Department of Communities and Justice. Ms D’Elia has an excellent track record in leading people-centred, innovative and service-oriented solutions that leverage technology. Ms D’Elia was responsible for delivering an ERP solution across 38 NSW government agencies (consisting of 30,000 employees), which is to be reused by other NSW government portfolios.

- Mr Chris Cawood. Mr Cawood is the Chief Information Officer, IXOM. Mr Cawood has over 30 years’ leadership and technical experience across heavy industry sectors including manufacturing, oil and gas, and mining and transport. Mr Cawood was heavily involved in a large ERP rollout at BHP.

- Mr Chris Fechner. Mr Fechner is the Chief Executive Officer at the Digital Transformation Agency (DTA). In addition to his current role advising the Australian Government on large scale digital and ICT reform and transformation programs, Mr Fechner has extensive experience in delivering large scale state government digital and ICT services, including ERP systems. Mr Fechner is also the Head of the Digital Profession.

Biographies of members of the Panel of Eminent People are at Appendix B.

The Assessment was supported by a DTA Secretariat.

The Panel was informed by:

- a technical assessment of potential reuse opportunities undertaken by ERP specialists, Reason Group Pty Ltd (at Appendix C). A draft of this technical assessment was shared with key stakeholders (Services Australia, Finance, and the Attorney-General’s Department (AGD)) for fact-checking purposes

- input from an ERP Consultative Committee (comprised of senior APS and ACT government executives) and its supporting working group

- key themes drawn from a series of 13 interviews the DTA Secretariat held with ERP Consultative Committee members (as ERP experts from across the APS and ACT government), and

- analysis undertaken by the DTA.

Entities represented in the Assessment’s interviews, ERP Consultative Committee, and working group are specified at Appendix D.

The Assessment was also informed by additional consultation activities undertaken by the DTA Secretariat (and, where relevant, supporting technical experts from Reason Group Pty Ltd) as follows:

- four-day discovery workshops with Services Australia

- engagement with senior executives from Services Australia, Finance, AGD, and Defence

- meetings with select vendors and industry participants, SAP and 8Common, and

- collection and review of desktop evidence, with scrutiny of over 300 artifacts held by Finance, the DTA, Services Australia and other relevant stakeholders.

Regular updates were also provided to the Digital Leadership Committee, the APS ERP Approach Reference Group, and the DTA’s Executive Board. On 20 May 2024, the DTA Chief Executive Officer shared preliminary findings and insights of the Assessment with of the Services Australia Chief Executive Officer (at Appendix E).

A draft of this report was shared with Services Australia and Finance stakeholders for factchecking and comment on 6 June 2024. In addition, the draft report was shared with the Finance Minister’s office. Key observations and draft recommendations were also tested with the Assessment’s working group.

Off -

-

-

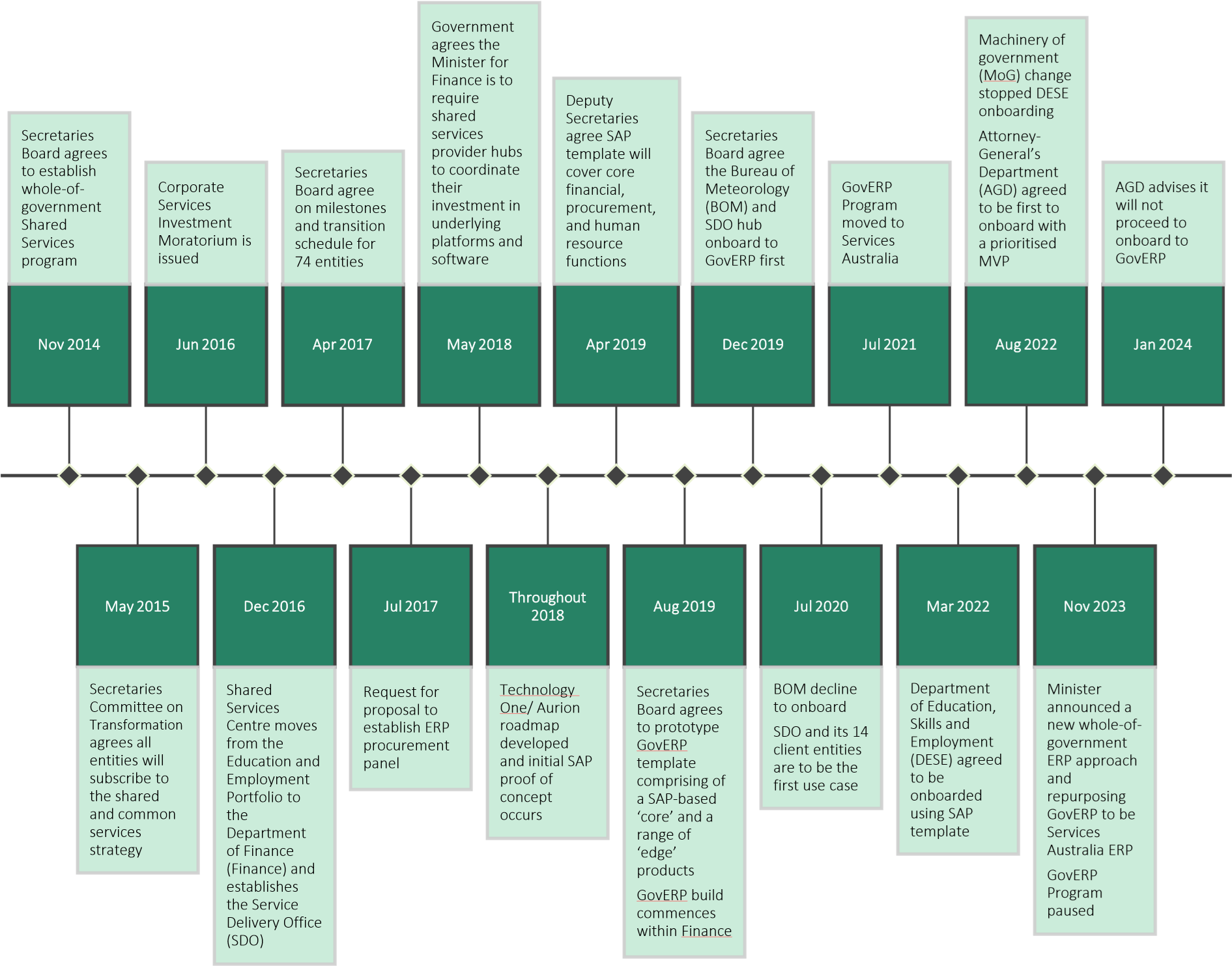

2.3 GovERP project history

The Shared Services Program, led by Finance, commenced in 2014 with approval from the Secretaries Board. In 2019 the Secretaries Board agreed that Finance prototype GovERP, the enabling technology for the program.

- The GovERP Program aimed to consolidate and standardise common transactional corporate APS processes and services aiming for cost-effectiveness, scalability, and advancing the one-APS vision, all while enhancing Australia’s digital capability.

- The platform was to replace a wide range of disparate systems across government (including the ERP systems then in use by shared services hubs at Finance, the Department of Foreign Affairs and Trade, the Department of Home Affairs, Services Australia, and the Department of Industry, Science and Resources) with a single across-government platform.

On 14 September 2020, the Shared Services Steering Committee defined a suite of functional (and other) capabilities as the minimum necessary for a whole-of-government GovERP model. These 54 functional capabilities were grouped by ‘value streams’, notably: human resources (Hire to Retire), procurement (Procurement to Pay), financial (Budget to Report and Revenue to Bank), as well as travel and expense management. These are outlined at Appendix F.

2.3.1 GovERP in Services Australia

In July 2021, the GovERP Program moved to Services Australia. Services Australia’s GovERP program was intended to comprise a SAP based core (see Reference 1) with a series of software solutions able to be added to provide specific functionality.

The previously defined suite of 54 functional capabilities, considered to be the minimum necessary for a whole-of-government GovERP model, was revised in consultation between Services Australia and its nominated client for initial onboarding (AGD). This revised minimum viable product (MVP), also outlined at Appendix F, reflected a more targeted suite of 39 ERP functional capabilities.

For the purposes of this report, references to MVP1.0 reflect the original Shared Services Steering Committee-defined scope of 54 functional capabilities for whole-of-government purposes, and MVP1.1 refers to the revised scope of 39 functional capabilities intended for initial onboarding of AGD.

2.3.2 New APS ERP approach

In November 2023, the Minister for Finance announced the scaling back of the broader GovERP program, concurrently introducing an updated program titled “A new approach for back-office functions in the Australian Public Service.” (see A new approach for back-office functions in the Australian Public Service.)

The new APS ERP approach replaces the Shared Services Transformation Program and sets the strategic direction for how the APS will manage its ERP corporate systems, underpinned by the principles of choice, market competition, and affordability.

The new APS ERP approach reflects a move away from highly aggregated demand for shared services (premised on a whole-of-government ERP system) to more distributed models with some areas to be a hub or provider, but in most cases letting entities directly use ERP capabilities themselves.

On 5 January 2024, AGD advised it no longer intended to proceed with onboarding to GovERP (Services Australia 2024).

In February 2024, the related GovERP governance committees were dissolved (Services Australia Chief Information Officer 2024). GovERP was also renamed to SA ERP to reflect the APS ERP approach no longer pursuing a wholeof-government build. It was intended that GovERP designs be repurposed for use by Services Australia, and any entities who choose to use it, pending the outcomes of this reusability assessment (see A new approach for back-office functions in the Australian Public Service). In subsequent correspondence of 26 April 2024, the Hon Bill Shorten MP advised, Services Australia has refocussed efforts to determine the functional requirements of the ERP solution for Services Australia”…and “[t]he remaining [GovERP] budget [of $21.8m] will be used to continue sustainment of the current ERP solution” (see Reference 4).

The Panel recognises that multiple APS entities will likely be coming forward soon for ERP uplifts as the need for well-functioning ERP capabilities across government has not abated. These uplifts reflect core underpinning capability of all government entities. As such, formal cross-APS governance structures are needed to ensure common approaches and limit customisations as much as possible.

Guidance from senior executives, such as Secretaries Data and Digital Committee (SDDC), is particularly important in anticipation of removal of the government’s existing investment moratorium on ERPs.

-

Eminent Panel Member Insight – Mr Chris Cawood – 13 May 2024

Experience from the heavy industry sectors suggests ERP implementation requires a sustained commitment and continuity from the top, as they are hard to execute and stay the course through the ups and downs of what is usually a complex project.

Off -

-

-

Key observation 1:

The shifts in GovERP’s scope, changes in ownership, and limited stakeholder consistency (as evidenced by multiple changes to the entities identified for initial onboarding) have culminated in a program that has not delivered as originally intended.

The volatility, and ambiguity in ownership and accountability, has resulted in an underdelivering project. The need for well-functioning ERP capabilities across government has not abated.

Recommendation 1:

- As core underpinning capability of all government entities, ERP uplifts need clear ownership and accountability mechanisms established at both the COO Committee and Secretaries Data and Digital Committee (SDDC) levels, to ensure considered uplift sequencing and to promote common approaches with limited customisations.

- To ensure equitable access to market resources across entities, overarching SDDC governance is needed to support successful ERP uplifts and implementation across government.

-

GovERP reuse assessment delivery and expenditure

-

References

- That is, GovERP was premised on use of SAP as the fundamental technology building block for the program. The program then envisaged an additional series of software solutions to extended this basic or core functionality, if needed.

- Services Australia, January 2024 DTA Approved Programs Collection (Wave 24) Project Collection Survey Form, January 2024

- Services Australia Chief Information and Digital Officer, email Dissolution of GovERP Programme Board, 5 February 2024

- See Appendix E, letter from Minister of Government Services to Minister for Finance, 26 April 2024.

-

3. Delivery and expenditure

3.1 Expenditure to date

The Assessment has identified investments of $340.6 million since 2019-20 in development and transition to GovERP as outlined in Table 2.

-

Table 2 GovERP investment Source Entity Purpose 2019-20 $ m 2020-21 $ m 2021-22 $ m 2022-23 $ m Total $m 2021-22 Budget (May 2021) (see note a) Services Australia To: (see note b)

• Build GovERP technology platform

• On-board entities to GovERP

• Transition the SDO Provider Hubs

• Program management126.4 119.7 Services

Australia total $246.1Department of Industry,

Science

Energy and

Resources

(DISER)Business case development to develop SecondPass Business Cases for further adoption of GovERP and the design of suitable standardised technologies for small and medium entities 2 DISER total $2.0 Australian

Taxation

Office (ATO)3.3 ATO total $3.3 Department of Finance 2.5 Department

of Finance

totalDepartment of Finance Onboarding readiness and legacy systems assist the SDO client entities to prepare for the transition to the GovERP platform, including the integration and decommission of legacy systems that result from onboarding to GovERP 19.6 $89.20 2020-21

Budget

(October 2020)Department

of FinanceTo develop the GovERP model and Whole-of-government Business Case 35.6 Modernisation

Fund

(August 2019)Department

of FinanceTo progress a GovERP prototype 31.5 Total $340.60 Table source: Department of Finance, Additional Information Factsheet Shared Services Overview (incl GovERP), 15 May 2024.

-

Table notes

- Note a: Not all of the figures presented in this table are readily identifiable in historical budget papers. Given the commercial sensitivities at the time, GovERP-related payment measures in the 2021-22 Budget (for example) were listed as “nfp” (not for publication) – refer 2021-22 Budget Paper 2, page 77.

- Note b: This consisted of:

- Build GovERP technology platform: lead the design, build and operation of the SAP GovERP platform (including the SAP template and the technology hub) – $159.7 million over 2 years

- On-board entities to GovERP: on-board 14 of the Service Delivery Office’s (SDO) client entities onto the GovERP platform, including roll out of the GovERP solution, cut over to business-as-usual and close-out issues to sustain – $20.3 million over 2 years

- Transition the SDO Provider Hubs: lead the SDO Provider Hub uplift, including build of the GovERP instance and onboarding cut-over activities – $11.1 million over 2 years

- Program management: lead whole-of-government program arrangements in line with client capability needs, including design and oversight functions – $55 million over 2 years.

-

-

-

Services Australia has advised that, of the $246.1 million allocated as its budget for GovERP, $198.15 million had been spent as of 31 December 2023 (Services Australia January 2024). The Minister for Government Services has subsequently advised (see Reference 2) that the remaining budget will be used to continue sustainment of the current ERP solution, including ongoing licensing and hosting costs of the platform, see Appendix D.

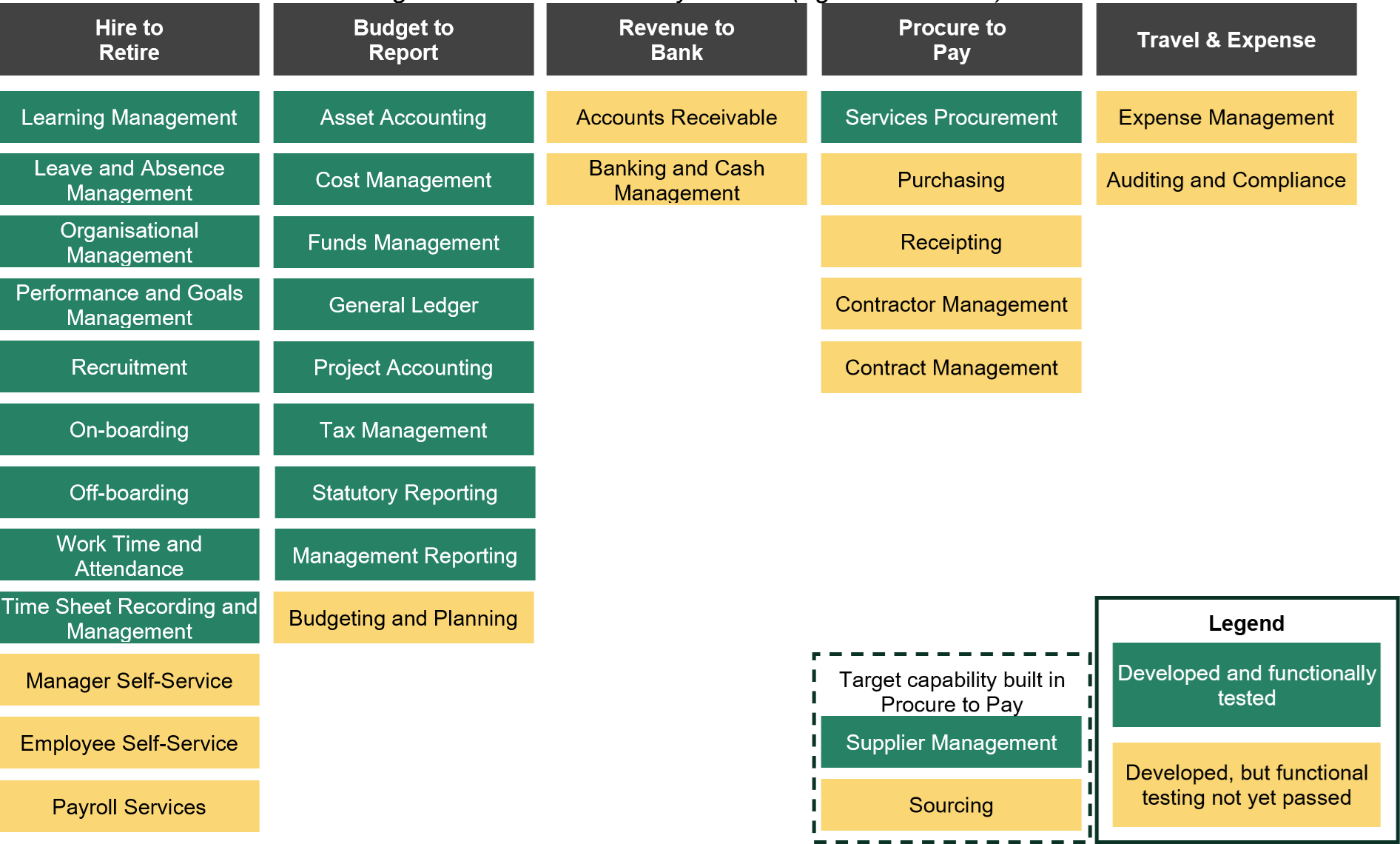

3.2 Delivery to date

The Panel understand that 30 capabilities (out of 39 functional capabilities of the MVP 1.1) have been developed to date, with a subset of 18 of these capabilities having completed functional testing.

Development and functional testing have primarily focused on:

- human capability management-related capabilities (hire to retire), with 9 capabilities having completed functional testing to date;

- financial management-related capabilities (budget to report), with 8 capabilities having functional completed testing; and

- procurement-related capabilities (procure to pay), with one capability having completed functional testing.

The Panel could not confirm through evidence that travel and expense management-related capabilities completed GovERP functional testing. However, a key vendor (8common) has advised that all build elements for the travel and expense management tool (Expense8; see Reference 3) have been completed and functionally tested, albeit not explicitly integrated as part of the MVP 1.1 GovERP solution.

Figure 2 GoverERP delivery to date (against MVP1.1) Note: Figure 2 shows DTA analysis based on Appendix C, Reason Group technical assessment report.

-

-

Figure description

The table above contains the following information:

1. Hire to retire

Developed and functionally tested

• Learning management

• Leave and absence management

• Organisational management

• Performance and goals management

• Recruitment

• On-boarding

• Off-boarding

• Work time and attendance

• Time sheet recording and managementDeveloped, but functional testing not yet passed

• Manager self-service

• Employ self-service

• Payroll services2. Budget to report

Developed and functionally tested

• Asset accounting

• Cost management

• Funds management

• General ledger

• Project accounting

• Tax management

• Statutory reporting

• Management reportingDeveloped, but functional testing not yet passed

• Budgeting and planning

3. Revenue to bank

Developed, but functional testing not yet passed

• Accounts receivable

• Banking and cash management4. Procure to pay

Developed and functionally tested

• Services procurement

Developed, but functional testing not yet passed

• Purchasing

• Receipting

• Contractor management

• Contract management4a. Target capability built in procure to pay

Developed and functionally tested

• Supplier management

Developed, but functional testing not yet passed

- Sourcing

5. Travel & expense

Developed, but functional testing not yet passed

• Expense management

Off

• Auditing and compliance -

-

-

Components built-to-date were prioritised around the functionality required to onboard AGD (i.e. MVP1.1). There are some positive foundational features, however, existing capabilities are not sufficiently developed to address the MVP1.0 capabilities necessary for broader use across government.

3.3 Remaining work

As part of its terms of reference, the Panel was asked to advise on any remaining work envisaged to complete GOVERP. The Panel understands the following functional capabilities have not yet been developed and would require progression to complete the MVP1.1 (refer Appendix F):

- Budget to Report – 2 capabilities (18 per cent of 11 functional capabilities envisaged for this value stream under MPV1.1): Commonwealth Reporting, and Lease Accounting

- Hire to Retire – 1 capability (8 per cent of 13 MPV1.1 functional capabilities): Employee Management

- Procure to Pay – 4 capabilities (44 per cent of 9 MPV1.1 functional capabilities): Accounts Payable, Report Procurement Activities, E-procurement, and Whole-of-government Purchasing (see Reference 4)

- Travel and Expense – 2 capabilities (50 per cent of 4 MPV1.1 functional capabilities): (see Reference 5) Credit Card Management and Travel Management.

The Panel notes that, while functional testing has been completed for some capabilities, no system integration testing or user acceptance testing appears to have occurred as part of activities to date. Such testing is critical to completion of trusted and operational ERP (see Reference 6). Services Australia has stated (Services Australia June 2024):

- SIT [system integration testing] and UAT [user acceptance testing] were planned prior to the implementation of Attorney-General’s Department (AGD) and were scheduled. SIT was to commence November 2023 and UAT early 2024

- [System integration testing and user acceptance testing may] have been completed if the programme was not ceased mid-flight.

3.3.1 Potential costs, risks, and benefits of remaining work

The Panel is mindful that progressing development of the capabilities identified in Section 3.3 for AGD’s deployment (i.e. MVP1.1) may not be sufficient to complete GovERP.

In correspondence of 26 April 2024, the Hon Bill Shorten MP advised, “The development of the current ERP solution had primarily focussed on meeting the Attorney-General’s Department’s requirements, which in its current form are not suitable to meet the expansive operational requirements of Services Australia.” (see Reference 8).

Considering Minister Shorten’s advice that the current ERP solution is not suitable to meeting Services Australia’s requirements, the Panel notes the 18 functional capabilities completed to date falls short of both the MVP1.1 (of 39 functional capabilities) and the MVP1.0 for whole-of-government purposes (54 functional capabilities). In this context, the objective of a standardised, common transactional corporate service will not be achieved by GovERP, even if it is further developed to carry out the remaining work to complete the MVP1.1.

Additionally, the underlying technical stack is no-longer current for GovERP’s financial and procurement-related capabilities, with a version change released in 2023. Updating to more current versions is necessary to ensure appropriate functionality, reduce ongoing out year maintenance, and to remain on the upgrade path.

-

Eminent Panel Member Insight – Mr Chris Fechner, 16 May 2024

Fully managed ERP services across the Commonwealth do not have a good record of performance. Generally, over the previous decade, only minimum support upgrades have been applied, and versions of SAP across the Commonwealth are at elevated levels of risk due to falling behind in the currency of the software.

Off

Connect with the digital community

Share, build or learn digital experience and skills with training and events, and collaborate with peers across government.