Projects under central oversight

The processes described in the last section ensure the Australian Government can closely monitor and report on the performance of all its major digital projects.

This section sets out the projects now under central assurance oversight and changes since the last digital project data release in February 2024.

Central oversight now covers 110 active projects, up by 22, with an additional $6.7 billion in investment

Note: Since February 2024, 32 projects have left central oversight. Of these, 20 have closed, 10 now fall outside the scope for assurance oversight and one has been absorbed by an existing project. One project that was included as active in February 2024 closed prior to this report, however, continued to receive advice and assurance on closure activities, and was reported as active for this purpose.

Since the last report in 2024, 54 projects entered central oversight as part of the IOF, and 32 left. A further 56 projects that reported in 2024 continued under oversight this year.

The number of projects under assurance oversight will continue to change over time as new projects start, projects previously out of scope meet the criteria for inclusion following changes such as additional investment, and other projects close.

Since February 2024, of the 54 projects that have come under assurance oversight:

- 21 projects were previously funded, either during the 2023–24 Mid-Year Economic and Fiscal Outlook (MYEFO) or earlier, but only came under central oversight after the last report in February 2024

- 33 projects were newly funded in the 2024–25 Budget and are being delivered across 25 agencies.

Active projects by tier, budget and average duration

Most projects coming under central assurance oversight in the past year have been Tier 2 and Tier 3 level investments

| Investment tier Projects | Total budget | Median total budget | Average duration | |

|---|---|---|---|---|

| 1 Flagship digital investments |

9 |

$1.3 billion |

$154.7 million |

3.2 years |

| 2 Strategically significant digital investments |

20 |

$5.7 billion |

$58.8 million |

3.6 years (see the table note) |

| 3 Significant digital investments |

25 |

$1.4 billion |

$24.0 million |

2.2 years |

Table note: Tier 2 average project duration is affected by 2 outlier projects, each with a duration of 35.0 years. Average duration including these 2 projects is 6.9 years.

Tier 3 projects made up the largest number of additional projects. These projects are usually lower risk and have smaller budgets, with most investing in ‘sustainment’ and ‘product/service enhancement’ rather than establishing wholly new digital capabilities. The increase in Tier 3 investments reflects ongoing efforts to move away from higher-risk large and complex projects to smaller, ‘bite-size’ projects where possible. Evidence suggests these smaller projects generally have a higher rate of success.

Large investments will still be necessary in some cases, and several have been commissioned since the last report. Strong planning and oversight are crucial to ensure new higher-risk investments do not exceed available delivery capacity. Strengthening central oversight, including digital investment planning and prioritisation, is key to balance project loads within capacity and coordinate efforts to expand capabilities of agencies and delivery partners to handle expected growth in digital investment.

Reforms supporting success – planning for the future

From the 2026–27 Budget, Commonwealth agencies will be required to develop digital and ICT investment plans. This will provide a future-focused understanding of the complexities across the government’s digital and ICT landscape and identify future need for investment in digital services.

Digital and ICT investment plans will provide short, medium and long-term views of projects. This will help to balance capacity, instil a culture of strategic digital investment planning focused on the future, improve understanding of criticality and risk, and support long-term ambitions to achieve better digital outcomes for Australians as part of the Data and Digital Government Strategy. The investment plans will also increase visibility of digital investments across agencies, enabling the trial and adoption of new technologies, greater coordination of digital enhancements, and more integrated service delivery across agencies.

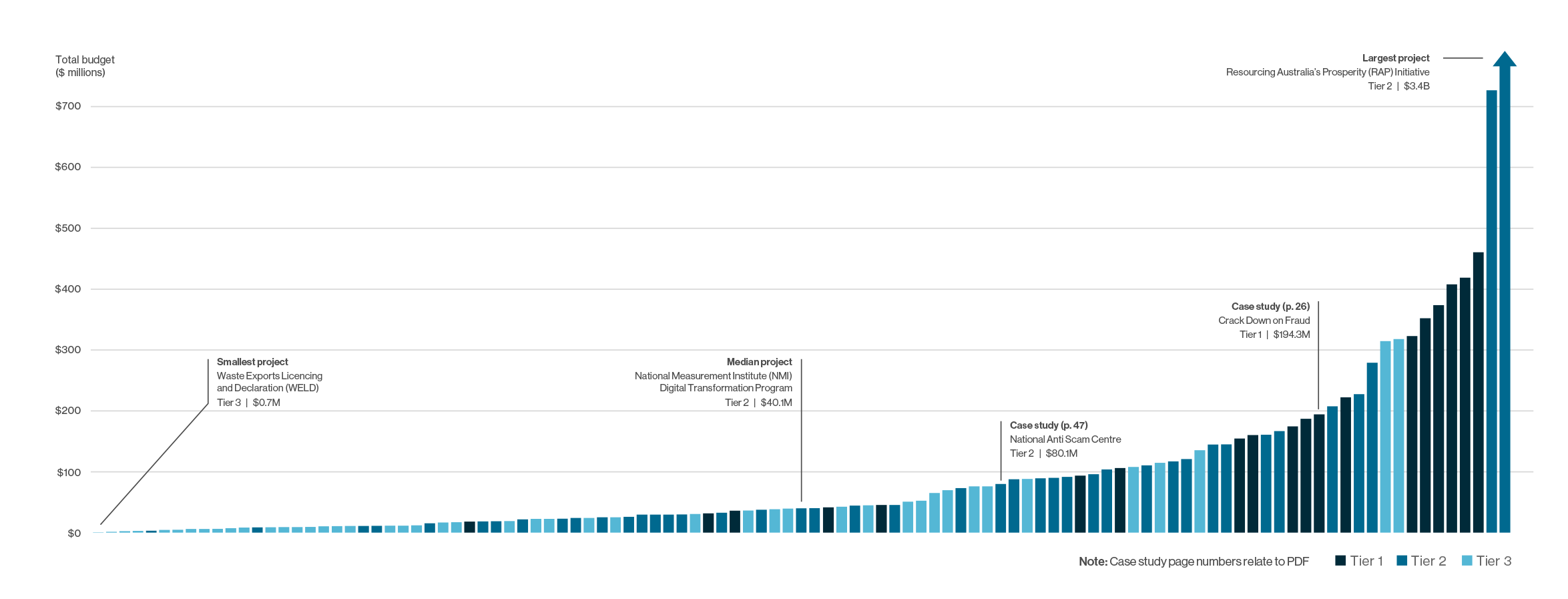

The distribution of project by total budget highlights the diversity of projects underway across the Australian Government

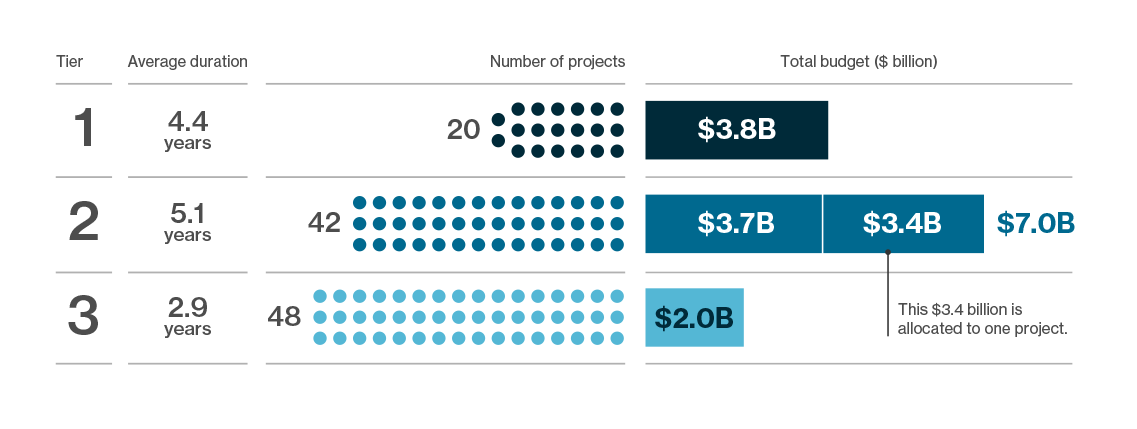

Tier 2 and Tier 3 projects make up the bulk of all active projects under central assurance oversight

Of note, almost half of the total budget of all Tier 2 projects relates to a single, multi-decade investment, valued at $3.4 billion. This outlier project skews the average budget of Tier 2 projects ($167.8 million) and means the median budget of $45.0 million better reflects their typical size.

Flagship digital investments (Tier 1) represent 18.2% of active projects and approximately 29.6% of the total budget. Just over half of all Tier 1 projects are reporting a planned completion date between June 2025 to June 2026. Strong ongoing investment planning and prioritisation within each of these projects will be essential for Senior Responsible Officials to smoothly deliver these projects over the next 12 months.

For all tiers, experience shows that the projects most likely to deliver expected benefits on time and on budget have robust approaches to key project management disciplines including governance, risk, benefits and assurance. Strengthening approaches in these areas is a priority for the DTA in our work overseeing all the digital projects included in this report.

Disclaimer

“Certain numbers in this report have been rounded to one decimal place. Due to rounding, some totals may not correspond with the sum of the separate figures.”